Understanding our beliefs about money is crucial for personal and financial growth. These beliefs, whether we’re aware of them or not, shape our financial behaviors and, ultimately, our lives.

Today, we delve deep into one specific money belief archetype that at Conscious Wealth Builder we call the “Money Trap.” This archetype is characterized by a feeling of being financially trapped, where money seems scarce and financial growth feels out of reach despite your best efforts. If you’ve ever felt powerless over your financial situation, chances are you’re stuck in the Money Trap. Remember, it’s completely normal to have these beliefs, and many have successfully navigated their way out of this trap. It’s a journey, and with the right mindset and tools, it’s entirely achievable.

Explanation of the Framework

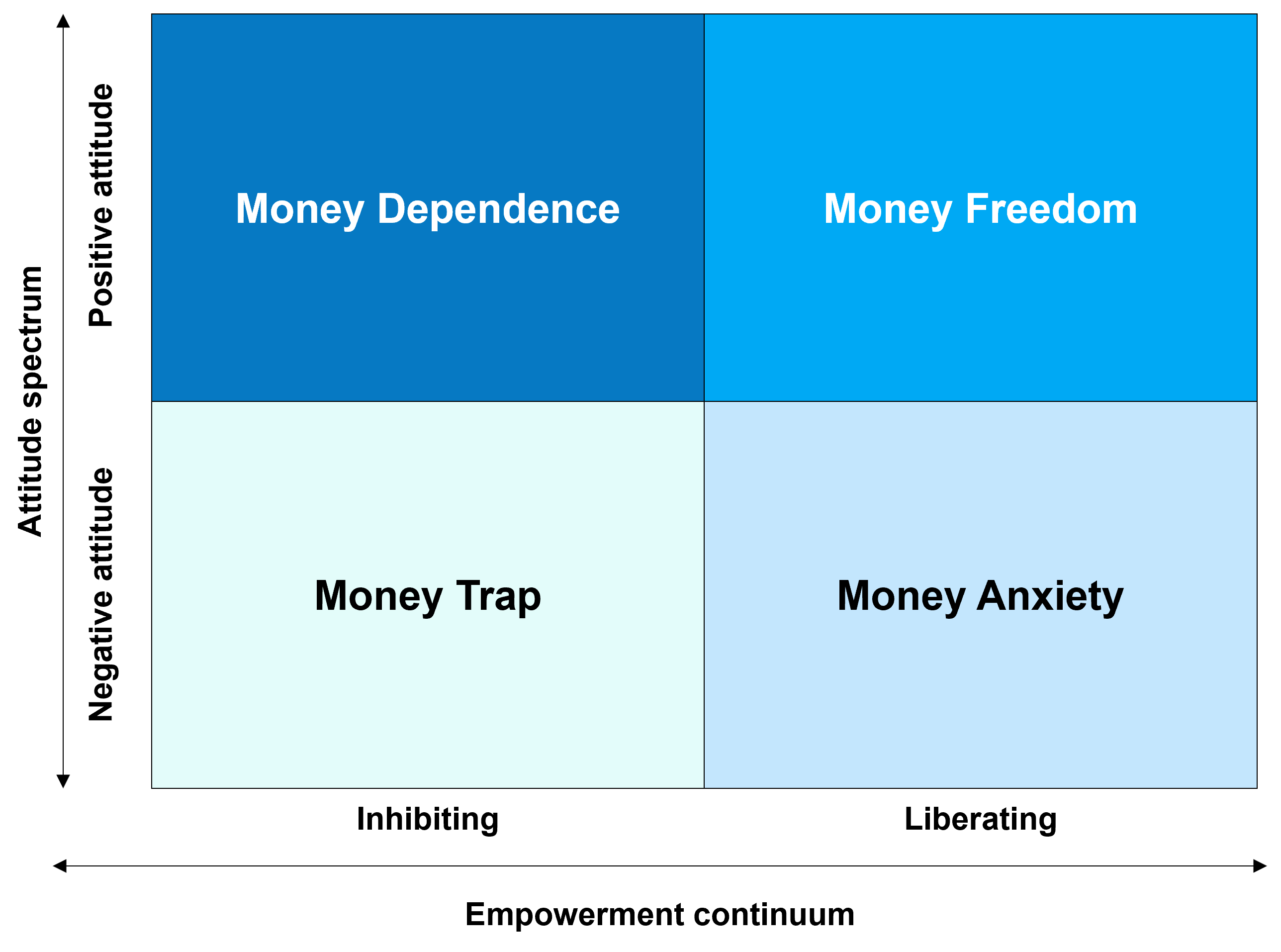

Before we explore the Money Trap archetype in detail, let’s quickly recap our Money Beliefs Framework. This framework is built upon two main dimensions: the empowerment continuum and the attitude spectrum. These dimensions assess the degree to which your beliefs about money empower you to take control of your financial life (liberating) or restrict your ability to pursue financial growth and success (inhibiting), and whether your beliefs about money positively or negatively impact your well-being and financial behavior.

The Money Trap falls into the quadrant of inhibiting and negative beliefs, where financial growth seems like a distant dream.

Deep Dive into the Money Trap Archetype

The Money Trap archetype embodies a profound sense of financial entrapment, where individuals feel stuck in scarcity and powerlessness despite their efforts. This deep dive explores the specific beliefs, stories, emotions, and behaviors that define this quadrant.

Example Beliefs

- “I believe money is scarce and difficult to come by.”

- “I believe financial success is only for the lucky few, not for me.”

- “I believe I’ll never escape the cycle of debt and struggle.”

- “I believe money is the root of all my problems.”

- “I believe I’ll never be able to afford the things I truly want or need.”

These beliefs form a psychological barrier that inhibits individuals from pursuing or achieving financial growth, reinforcing a narrative of limitation and lack.

Example Money Stories That Led to the Beliefs

- John’s Cycle of Debt:

John grew up in a family that lived paycheck to paycheck, inheriting the belief that money was always scarce and hard to manage. Despite his efforts, he finds himself trapped in a cycle of debt, reinforcing his belief that financial stability is out of reach. - Emma’s Failed Business Venture:

After her small business failed due to market downturns, Emma felt financially crippled. She views her financial downfall as inevitable, reinforcing her belief in her inability to achieve financial success. - Liam’s Layoff Aftermath:

Losing his job unexpectedly, Liam struggled to cover basic expenses. This experience led him to believe that security is a myth and that he’s powerless to improve his financial situation. - Sophia’s Savings Gone:

An emergency drained Sophia’s savings, leaving her without a financial safety net. She feels vulnerable and trapped, believing she’ll never be able to build enough wealth to feel secure again. - Alex’s Inheritance Fears:

Witnessing relatives squabble over an inheritance, Alex fears that money only leads to conflict. Coupled with a lack of financial knowledge, he feels powerless and cynical about financial growth.

Our financial beliefs are often rooted in personal experiences or narratives we’ve observed from an early age. These money stories illustrate how specific events and circumstances can shape our perceptions of money, embedding beliefs that contribute to the Money Trap.

Emotions Experienced

- Fear of financial failure and never being able to get ahead.

- Feeling trapped in a cycle of struggle, resigning to the situation.

- Anxiety about not having enough to meet basic needs and financial obligations.

- Helplessness and overwhelm in the face of financial challenges.

- Frustration and anger towards the perceived unfairness of financial circumstances.

These emotions are powerful and deeply affect one’s financial decision-making and well-being, further entrenching individuals in the Money Trap.

Behaviors Displayed

- Hoarding money instead of investing or spending it, driven by fear of scarcity.

- Avoiding financial decisions or opportunities out of fear of making the wrong choice.

- Living paycheck to paycheck without saving for the future, due to a sense of hopelessness.

- Holding onto outdated or ineffective financial strategies, resisting change.

- Spending money irrationally as a temporary escape from financial stress.

These behaviors are manifestations of the deep-seated beliefs and emotions characteristic of the Money Trap. They not only perpetuate financial struggle but also hinder the path to empowerment and freedom.

Implications and Effects

The Money Trap doesn’t just affect how you handle money; it influences various aspects of your life. Understanding these implications can be the catalyst for seeking change.

- On Personal Finance:

Being caught in the Money Trap severely limits your ability to make informed financial decisions, save for the future, or invest in growth opportunities. The scarcity mindset leads to behaviors like hoarding money or avoiding financial decisions, which can result in missed opportunities for wealth creation. Additionally, this mindset often leads to living paycheck to paycheck, with little to no emergency fund or savings for long-term goals, such as retirement or homeownership. The cycle of debt becomes a common theme, as you may rely on credit for immediate needs without a clear plan to pay it back, exacerbating financial stress. - On Well-being:

The emotional toll of the Money Trap is significant. Constant stress and anxiety about finances can lead to mental health issues such as depression and anxiety disorders. The fear of financial instability can overshadow other aspects of life, reducing overall happiness and satisfaction. This stress can manifest physically, too, with symptoms like insomnia, headaches, and other stress-related health issues. The feeling of being trapped can also lead to a sense of hopelessness or a defeatist attitude toward life’s possibilities, limiting personal growth and fulfillment. - On Relationships:

Money beliefs also deeply affect interpersonal relationships. Financial stress can strain partnerships, as conflicts over money management, spending habits, and financial goals become more frequent. It can lead to social isolation, as you may avoid social situations due to perceived financial inadequacy or the fear of judgment. Within families, the Money Trap can create a legacy of limiting beliefs about money, as children often inherit their parents’ attitudes towards finances, perpetuating the cycle of financial struggle across generations. - On Decision Making and Opportunities:

The scarcity mindset influences more than just financial decisions; it affects your overall approach to life’s opportunities. You may shy away from career advancements, educational opportunities, or personal growth endeavors due to fear of failure or financial risk. This cautious approach can lead to a life lived within a very narrow comfort zone, limiting your potential for success and fulfillment.

Strategies for Change

Breaking free from the Money Trap requires a multifaceted approach that addresses beliefs, emotions, and behaviors. Here’s how you can begin the journey towards financial liberation and empowerment:

- Identify and Challenge Limiting Beliefs:

Start by identifying the beliefs that hold you back. Write them down and challenge each one. For example, if you believe “money is scarce,” question this belief by seeking out stories of financial growth and abundance. Remind yourself that money can be created, earned, and multiplied through informed actions and decisions. - Rewire Your Financial Mindset:

Practice mindfulness and positive affirmations to shift your mindset towards abundance. Regularly affirm your capability to manage finances wisely and grow your wealth. Mindset shifts are powerful; they can transform how you perceive financial opportunities and challenges. - Educational Empowerment:

Invest in your financial education. Knowledge is power, especially when it comes to managing your finances. Utilize books, online courses, workshops, and podcasts to build your understanding of budgeting, investing, saving, and debt management. - Set Small, Achievable Goals:

Break down your financial journey into small, manageable goals. Achieving these smaller goals can build confidence and momentum, making the larger journey seem more attainable. Whether it’s saving a small amount weekly, paying off a minor debt, or investing in a beginner-friendly investment, each step is progress. - Implement Practical Financial Tools:

Leverage tools and resources to better manage your finances. Budgeting apps can help track spending and saving, while financial planners or advisors can offer personalized advice. Also, consider using debt management tools or services to tackle debt in a structured way. - Foster a Supportive Community:

Surround yourself with people who support your financial goals and understand the journey you’re on. This can be through online communities, financial literacy groups, or friends who share your ambition for financial growth. A supportive environment can be incredibly motivating. - Practice Gratitude and Generosity:

Cultivating gratitude can shift your focus from scarcity to abundance. Generosity, even in small acts, can reinforce the belief in abundance and the flow of money. When you give, you affirm to yourself that there is enough to share. - Seek Professional Help When Necessary:

If financial anxiety or debt is overwhelming, consider seeking professional financial counseling or therapy. These professionals can provide tailored strategies and support to navigate complex financial situations.

Adopting these strategies requires time and patience. Change won’t happen overnight, but consistent effort can gradually shift your beliefs and behaviors from the Money Trap towards Money Freedom. Remember, the journey towards financial empowerment is both individual and incremental. Celebrate your progress and stay committed to your path to financial well-being.

Conclusion

The Money Trap can feel confining, but it’s not inescapable. By understanding and addressing the underlying beliefs and emotions, anyone can start to move towards a more empowered and positive financial future. Reflect on your beliefs, identify steps you can take to challenge them, and remember, the journey to financial freedom is both possible and rewarding.

Do you feel you may be stuck in the Money Trap? Let me know in the comments what signs give you this impression. And if you managed to escape, what worked for you?