Our beliefs about money significantly influence not just our financial decisions but our emotional well-being. The archetype of “Money Anxiety” is particularly revealing, characterized by a persistent worry over finances despite having the means or skills to manage them effectively. Individuals with money anxiety often find themselves in a paradoxical state, where their capability to manage finances does not alleviate their fears about the future or potential financial instability. This article aims to guide those experiencing money anxiety towards a state of financial serenity, demonstrating that with understanding and strategic action, it is possible to transform anxiety into assurance. Recognizing and addressing the roots of money anxiety is a vital step toward achieving a balanced and healthy financial perspective.

Explanation of the Framework

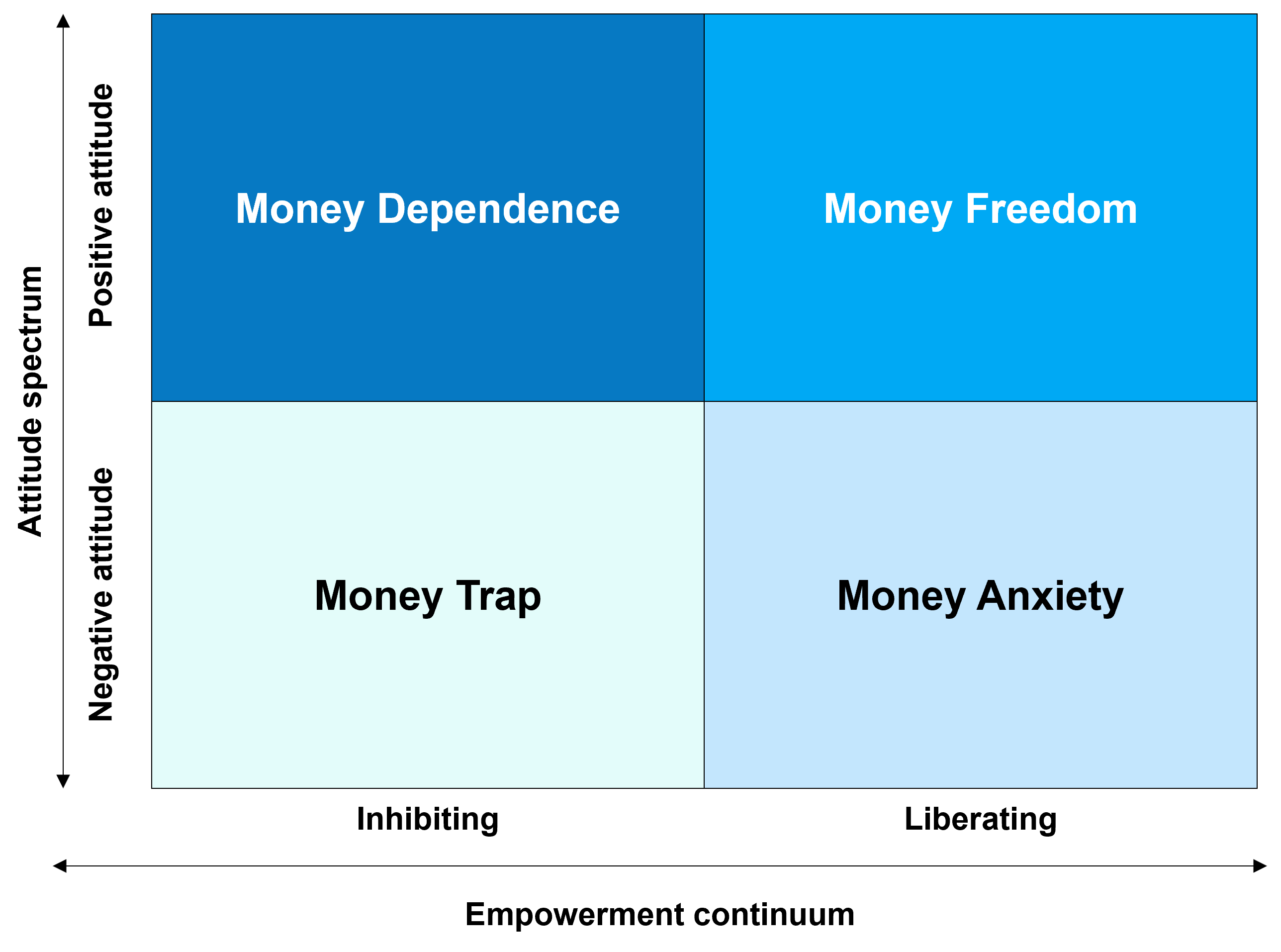

To contextualize Money Anxiety within the broader spectrum of money beliefs, let’s revisit the Money Beliefs Framework, which categorizes beliefs along the empowerment continuum and the attitude spectrum. This model evaluates whether your beliefs about money enable you to take control of your financial life (Liberating) or limit your financial growth (Inhibiting), and whether you view money in a positive or negative light.

Money Anxiety occupies a unique position in this framework, combining a liberating capacity for financial management with a negative emotional outlook. This blend results in a skilled yet apprehensive approach to personal finances.

Deep Dive into the Money Anxiety Archetype

Money Anxiety is defined by a combination of financial competence and underlying worry. This section delves into the beliefs, experiences, emotions, and behaviors associated with this archetype.

Example Beliefs

- “I believe my financial well-being is constantly under threat, no matter how well I manage my resources.”

- “I believe I can manage my finances well, yet I’m convinced that enjoying wealth could lead to its loss.”

- “I believe in the importance of saving and investing but am afraid of making the wrong choices.”

- “I believe the pursuit of wealth is fraught with too many risks and uncertainties.”

- “I believe having money always leads to more problems and stress.”

These beliefs highlight an internal conflict where financial prudence is overshadowed by fear of future uncertainties and potential loss.

Example Money Stories That Led to the Beliefs

- Tom’s Market Losses: Despite being financially savvy, Tom suffered losses in the stock market. Now, he manages his finances with skill but is haunted by the fear of another loss, leading him to overly cautious financial behavior.

- Jessica’s Inheritance Paranoia: After receiving a substantial inheritance, Jessica finds herself overwhelmed by the fear of mismanaging her newfound wealth, paralyzing her decision-making abilities.

- Derek’s High Income, High Anxiety: Earning a high salary, Derek feels capable in his financial management but worries incessantly about the stability of his income and the potential for financial disaster.

- Mia’s Survivor’s Guilt: Coming from a low-income background, Mia’s financial success as an adult brings her not joy but anxiety and guilt about having more than her family ever did, affecting her relationship with money.

- Carlos’s Early Retirement Fears: Having saved enough to retire early, Carlos still feels anxious about the longevity of his wealth and whether it will sustain him and his family, leading to a conservative lifestyle despite financial freedom.

These narratives reveal how past experiences and personal backgrounds can significantly influence one’s emotional relationship with money, contributing to the development of money anxiety.

Emotions Experienced

- Persistent worry about future financial stability.

- Stress from constant vigilance over financial decisions.

- Guilt or discomfort when spending or enjoying wealth.

- Fear of financial loss, despite having safeguards in place.

- Anxiety over economic fluctuations and their impact on personal finances.

Behaviors Displayed

- Excessive saving and frugality, often at the expense of personal enjoyment

- Budgeting meticulously to maintain a sense of control

- Overanalyzing financial decisions, leading to indecision or delayed action

- Conservatively investing or saving, prioritizing security over growth

- Constant monitoring of financial accounts, to comfort that finances are under control.

- Seeking excessive financial advice for reassurance due to lack of trust in own decision-making

Implications and Effects

The impact of Money Anxiety extends beyond personal finance, affecting psychological well-being, life satisfaction, and decision-making capabilities.

- On Personal Finance:

While individuals with money anxiety may be adept at managing their finances, their aversion to risk and excessive caution can lead to suboptimal growth of their assets. Overemphasis on savings at the expense of investment can result in missed opportunities for wealth accumulation. Additionally, the constant pursuit of financial security may divert attention and resources away from other meaningful life goals. - On Well-being:

The persistent stress and worry characteristic of money anxiety can take a significant toll on mental health, contributing to anxiety disorders, depression, and stress-related physical health issues. The inability to enjoy financial stability and achievements can diminish overall life satisfaction and sense of accomplishment. - On Relationships:

Money anxiety can strain relationships, as financial decisions become sources of conflict, and the inability to enjoy wealth can limit shared experiences. Moreover, the internalization of financial fears may lead to social withdrawal or reluctance to discuss money matters openly.

Strategies for Change

Addressing Money Anxiety involves acknowledging and confronting fears, enhancing financial understanding, and fostering a healthier emotional relationship with money.

- Acknowledge and Confront Financial Fears

Begin by identifying specific financial worries. Reflect on their origins and validity, challenging unfounded fears. Understanding that no financial decision is without risk, but that informed choices can mitigate these risks, is crucial. - Enhance Financial Education

Deepen your understanding of financial markets, investment strategies, and economic principles. Knowledge can empower decision-making, reduce fear of the unknown, and build confidence in your financial planning abilities. - Develop a Balanced Financial Plan

Work on creating a financial plan that aligns with your life goals, risk tolerance, and financial situation. This plan should balance savings, investments, and spending, ensuring that you’re not sacrificing present enjoyment for future security unnecessarily. - Seek Professional Guidance

Consulting with a financial advisor can provide clarity, reassurance, and a second opinion on your financial strategies. Choose an advisor who understands your financial goals and concerns and can offer tailored advice. - Practice Mindfulness and Stress-Relief Techniques

Incorporate practices that reduce stress and anxiety, such as mindfulness, meditation, or physical exercise, into your daily routine. These techniques can help manage the emotional aspects of money anxiety, allowing for clearer and more composed financial decision-making.

Conclusion

Money Anxiety, with its complex interplay of financial competence and emotional turmoil, presents a unique challenge. However, by confronting the underlying fears, seeking knowledge and professional advice, and adopting a balanced approach to financial planning, it’s possible to navigate through this anxiety towards a place of financial peace and confidence. Embrace the journey towards overcoming money anxiety as an opportunity for growth, self-discovery, and ultimately, financial serenity.