Understanding our relationship with money is not just about managing finances better; it’s about unlocking the doors to freedom, satisfaction, and growth. Among the various archetypes that shape our financial beliefs, “Money Freedom” stands out as the pinnacle of financial empowerment. This archetype is characterized by a confident and positive approach to managing finances, driven by a belief in abundance and the pursuit of proactive financial strategies. If you’re aiming to transform your financial journey into one of growth, abundance, and true freedom, this article is your roadmap. Achieving Money Freedom is not only about enhancing your financial situation but also about fostering a mindset that promotes well-being, joy, and personal fulfillment.

Explanation of the Framework

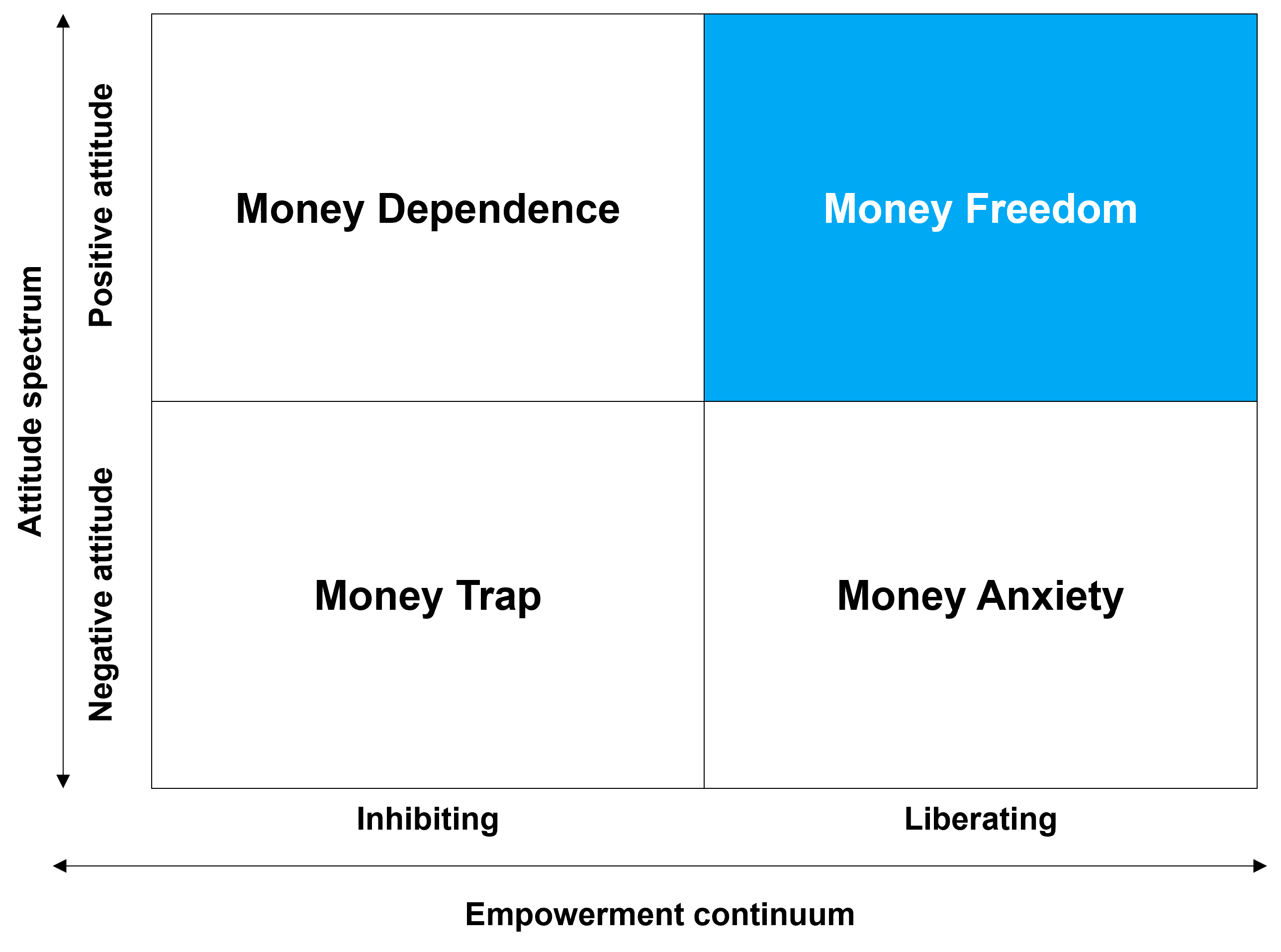

Let’s briefly revisit the Money Beliefs Framework that forms the basis of our discussion. This framework categorizes money beliefs along two axes: the empowerment continuum and the attitude spectrum. It helps us understand whether our beliefs about money empower us to take control of our financial life (Liberating) or restrict our ability to pursue financial growth and success (Inhibiting), and whether our views on money have a positive or negative impact on our well-being and financial behavior.

Money Freedom is located within the quadrant of liberating and positive beliefs. If you embody this archetype, you not only feel confident in your ability to manage your finances but also view money as a positive force in your life.

Deep Dive into the Money Freedom Archetype

Money Freedom is the embodiment of financial empowerment and optimism. This section explores the beliefs, practices, emotions, and behaviors that define this state.

- Example Beliefs

- “I believe in abundance and the potential for financial growth for everyone”

- “I believe that with the right knowledge and actions, I can achieve my financial goals”

- “I believe in the power of budgeting and strategic financial management”

- “I believe in investing for the future and taking calculated risks to create multiple income streams”

- “I believe I can make informed financial decisions that align with my values and goals”

These beliefs underscore a proactive and positive approach to financial management, highlighting an inherent trust in your ability to navigate the financial landscape successfully.

- Example Money Stories That Led to the Beliefs

1.Sara’s Entrepreneurial Success: Starting her own business was a risk, but Sara’s hard work paid off. She believes in the abundance money can bring and feels empowered to make smart financial decisions that align with her goals.

2.Ethan’s Investment Portfolio: Ethan educated himself on investing early in his career. His portfolio’s success has reinforced his belief in proactive financial management and the positive impact of financial freedom.

3.Zoe’s Debt-Free Journey: Zoe worked diligently to pay off her student loans early. This experience taught her the value of financial independence and the empowerment that comes from controlling her financial destiny.

4.Raj’s Career Advancement: By strategically navigating his career and negotiating his salary, Raj has achieved significant financial growth. He sees money as a tool for empowerment and is optimistic about his financial future.

5.Lily’s Real Estate Investments: Lily’s investments in real estate have not only provided her with passive income but also a deep sense of financial security and freedom. She believes in the power of strategic planning and investment for long-term wealth.

- Emotions Experienced

- Confidence in financial decision-making and management skills.

- Empowerment in taking control of financial destiny and pursuing goals.

- Optimism about the potential for financial success and abundance.

- Joy in seeing progress towards financial goals and milestones.

- Freedom in making choices aligned with personal values and aspirations.

- Gratitude for the financial situation and the opportunities it provides.

- Behaviors Displayed

- Proactive financial planning and goal setting.

- Regular review and adjustment of financial strategies to optimize growth.

- Making informed investment choices with a long-term perspective.

- Spending wisely while allowing for enjoyment and fulfillment.

- Sharing financial knowledge and resources with others to promote collective financial well-being.

Implications and Effects

Embracing the Money Freedom archetype has profound implications for personal finance, well-being, and overall life satisfaction.

- On Personal Finance Individuals experiencing Money Freedom excel in growing their wealth through smart investments and savings. Their strategic approach to financial management enables them to achieve financial independence earlier, providing them with the freedom to make life choices without financial constraints.

- On Well-being The confidence and security that come with Money Freedom contribute significantly to mental and emotional well-being. This positive financial state allows individuals to enjoy the present while planning for the future, leading to a balanced and fulfilling life.

- On Relationships Money Freedom fosters healthy financial relationships and conversations, as individuals are often willing and able to share their knowledge and success with others. This openness can strengthen personal relationships and create a supportive community focused on mutual growth and prosperity.

Strategies for Change

Attaining Money Freedom involves adopting a growth mindset, continuous learning, and strategic financial practices.

- Cultivate a Growth Mindset Embrace the belief that your financial capabilities are not fixed but can be developed through dedication and hard work. A growth mindset is crucial for overcoming setbacks and pursuing continuous improvement.

- Enhance Financial Literacy Commit to lifelong learning in the realm of personal finance to improve decision-making skills. Stay informed about investment strategies, market trends, and financial planning principles to make educated decisions.

- Set Clear Financial Goals Define what Money Freedom means to you and set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your journey.

- Embrace Strategic Risk-Taking Learn to identify and take calculated risks that have the potential to significantly boost your financial growth. Understand that risk is a part of the wealth-building process. Regularly investing in a diversified portfolio to build wealth over time.

- Practice Financial Generosity Share your wealth in ways that align with your values. Whether through charitable giving, investing in social causes, or supporting friends and family, financial generosity can enhance your sense of fulfillment and connection to the community and reinforce your belief in abundance.

- Foster Gratitude Regularly practice gratitude for your financial achievements and current standing. Acknowledging and appreciating what you have enhances your relationship with money and encourages a positive outlook towards future financial endeavors.

- Celebrate Wins and Milestones Recognize and celebrate each achievement on your path to Money Freedom. Whether it’s reaching a savings goal, making a successful investment, or simply sticking to your budget, celebrating these milestones reinforces positive financial behaviors and keeps you motivated.

Conclusion

Money Freedom is more than just a financial status; it’s a comprehensive approach to life that balances the pursuit of wealth with personal well-being and community involvement. By understanding and embodying the principles of this archetype, you can transform your financial journey into one of empowerment, joy, and boundless potential. Reflect on your current financial beliefs and practices, and consider how adopting the mindset and strategies of Money Freedom can elevate your financial life and beyond.