Within the spectrum of money beliefs lies the archetype of “Money Dependence,” characterized by an overarching reliance on external sources for financial security, despite a generally positive outlook on money. If you find yourself looking outward—to luck, others, or chance—for financial stability, this article is designed to guide you towards a path of self-reliance and financial autonomy.

Recognizing and addressing Money Dependence is a crucial step toward reclaiming control over your financial destiny. It’s a transformative journey from reliance to empowerment, achievable with the right mindset and actionable strategies.

Explanation of the Framework

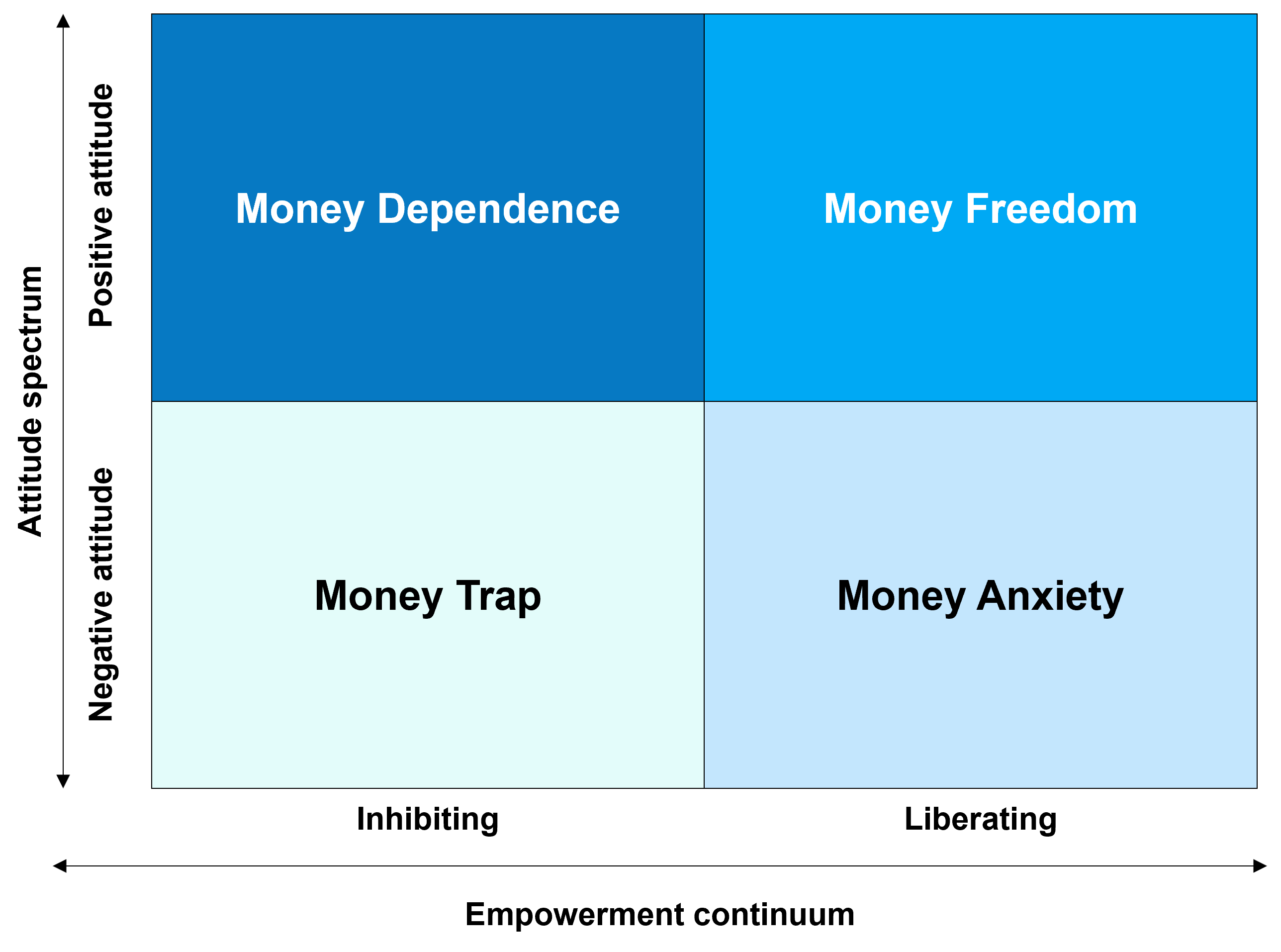

Before we delve into the Money Dependence archetype, a quick overview of the Money Beliefs Framework is essential. This framework evaluates beliefs along two dimensions: the empowerment continuum and the attitude spectrum, assessing how your views on money either empower you to take control of your financial life (liberating) or limit your financial growth (inhibiting), and whether these beliefs impact your well-being and financial behavior positively or negatively.

Money Dependence is situated within the inhibiting yet positive quadrant. If your dominant archetype is in this category, you likely acknowledge the importance and potential of money but often feel disconnected from your capacity to influence your financial future.

Deep Dive into the Money Dependence Archetype

Money Dependence is a pronounced reliance on factors outside oneself for financial stability, coupled with a positive belief in the benefits of money. This section unpacks the beliefs, narratives, emotions, and behaviors associated with this archetype.

Example Beliefs

- “I believe luck plays a crucial role in financial success.”

- “I believe relying on others for financial support is necessary for stability.”

- “I believe financial security comes from conforming to societal norms.”

- “I believe financial independence is unattainable without external validation.”

- “I believe financial stability depends on external factors beyond my control.”

These beliefs highlight a dependency mindset where financial stability is seen more as a consequence of external assistance or good fortune rather than the result of personal effort and decision-making.

Example Money Stories That Led to the Beliefs

- Grace’s Reliance on Parents:

Having always relied on her parents for financial support, Grace believes money is a source of security. However, she feels unable to manage her finances independently, heavily depending on her parents for financial decisions. - Mike’s Lottery Dream:

Convinced that a big lottery win is his ticket to financial freedom, Mike spends beyond his means, depending on luck rather than taking steps to manage his finances responsibly. - Peter’s Partner Dependency:

Peter views his partner as the financial provider and believes in the positive power of money for comfort and happiness. Yet, he feels incapable of contributing to or managing their joint financial future. - Oliver’s Investment Hesitance:

While Oliver believes in the growth potential of investments, he’s too scared to invest himself. He prefers to let his financial advisor make all the decisions, fearing that taking charge could lead to mistakes. - Hannah’s Windfall Waiting:

After a distant relative hinted at leaving her a significant inheritance, Hannah’s become complacent about her financial planning, believing this future windfall will solve all her financial problems.

Personal narratives such as these underline how experiences and societal pressures can forge a dependency on external factors for financial security and success.

Emotions Experienced

- Gratitude towards external support for financial stability.

- Optimism about the potential for luck or external sources to improve financial situation.

- Dependency on others for financial decisions and validation.

- Uncertainty about financial outcomes despite positive intentions.

- Comfort in conforming to societal expectations for financial security.

Behaviors Displayed

- Relying on others for financial advice and decision-making.

- Seeking financial assistance and support from family or friends.

- Excessive spending in anticipation of external rescues

- Avoiding financial risks to maintain stability and security.

- Conforming to societal expectations for financial success, even if it doesn’t align with personal goals or values.

- Neglect of personal financial management and disengagement from financial planning

Implications and Effects

The ripple effects of Money Dependence traverse various life aspects, subtly undermining personal growth, financial health, and autonomy.

- On Personal Finance:

Money Dependence can lead to precarious financial habits, such as inadequate savings, lack of investment, and an overreliance on credit, risking severe financial instability when external support wanes or luck turns sour. This reliance dampens the motivation for financial planning and prudent management, leaving individuals ill-prepared for financial emergencies or retirement. - On Well-being:

Though dependency might offer temporary comfort, it often breeds long-term stress, anxiety, and diminished self-worth. The perceived lack of control over one’s financial destiny can foster feelings of inadequacy and dependence, stifling personal development and the pursuit of genuine interests and goals. - On Relationships:

Financial dependence often strains relationships, creating dynamics fraught with power imbalances, resentment, or guilt. It can also limit social engagement and independence, as financial reliance influences one’s lifestyle choices, activities, and even friendships. - On Decision-Making and Opportunities:

The dependency mindset can lead to a passive approach to life’s opportunities, from career advancement to personal investments, due to fear of risking the financial security provided by external sources. This passivity can result in missed opportunities for growth, learning, and fulfillment.

Strategies for Change

Moving from Money Dependence towards financial independence involves reshaping deeply held beliefs, enhancing financial literacy, and fostering a proactive approach to personal financial management.

- Develop Financial Literacy

Begin by deepening your understanding of financial principles. Engage with resources that cover budgeting, investing, saving, and debt management. Financial knowledge empowers you to make informed decisions and build a foundation for independence. - Cultivate a Self-reliant Mindset

Challenge the belief that financial security must come from external sources. Practice affirmations that reinforce your capability and potential to achieve financial stability through your efforts. - Set Personal Financial Goals

Define clear, achievable goals that align with your aspirations. These should serve as milestones that guide your financial decisions and actions, fostering a sense of direction and purpose. - Embrace Decision-Making

Gradually assume responsibility for financial decisions, starting with minor choices and progressing to more significant financial commitments. This practice builds confidence and diminishes dependency. - Build a Support Network

Seek out communities and individuals who advocate for financial independence. Mentorship and peer support can provide encouragement, insights, and motivation on your journey to autonomy. - Engage with Financial Planning Tools

Utilize budgeting apps, financial planners, and other tools to take charge of your financial situation. Active engagement with these resources promotes a hands-on approach to money management.

Conclusion

While Money Dependence may currently define your financial narrative, it doesn’t have to dictate your future. By understanding this archetype and embracing strategies for change, you can pave the way towards a more empowered and financially independent life. Reflect on your beliefs, challenge your dependence, and take proactive steps towards reclaiming your financial autonomy. The path to financial independence is filled with opportunities for growth, self-discovery, and empowerment.

Do you feel you fiancially dependent? Let us know in the comments